Deduction Junction

1)How do they calculate taxable income for tipped employees?

2)Do they take into account cash sales and therefore the assumed cash tips on those sales?

—

- Taxable income for tipped employees is calculated by adding their reported tips to their regular wages. Your employer reports it in a W-2 provided to you at the end of the year. From there, the taxable income will be determined by your deductions and adjustments when you file your tax return and will be taxed at your regular tax rate.

- No, The IRS doesn’t make any assumption on the form the tips are paid. As a tipped employee you are responsible for keeping daily records of tips received and providing them to your employer so taxes may be withheld.

Deduction Junction,

We are filing for an LLC for our restaurant. Can we run all our tips through that LLC?

Do we pay ourselves a "salary" from the LLC? Can we write off all our eating out as business and networking meetings?

Can we write off uniform expenses, hair appointments, etc.?

—Zoe

Salaries and LLCs.

- If you are a single member LLC, the IRS doesn’t make any distinction between you and your LLC. What this means is that you can’t pay yourself a salary and deduct it as a business expense. Whatever money you take for your personal use is called distributions, which technically they are not taxable, but you are not able to take them as an expense either.

- Regarding the tips, I’m assuming that you mean that you as owner/owners will be serving, not your employees. If that is the case, it will be the same as the salary rules. All your income as an owner for a single member LLC or multiple member LLC will be considered distributions and you will be paying taxes based on the net income (all the sales minus expenses). You will also be subject to self-employment tax, and you must pay estimated tax payments.

- However, if you make the S-corporation election by filing form 2553, then you will be able to pay yourself a salary and take it as a business deduction. There are certain rules that you will have to follow if you ever decide to go this route.

Business Meals and Networking.

- About the eating/networking, although it is not impossible, it would be a little bit tough to prove that it is ordinary and necessary for your line of business. To put it simply, to be able to deduct meals, you will need to meet with customers to bring business in (mostly). Food that you buy because you forgot your lunch at home is not deductible. Although, if you invite, let’s say an accountant (I like Mexican food by the way) to talk business at a restaurant, then you should be able to deduct the cost of that. The IRS expects you to keep the receipts if you spent over $75, and document who and why, including the topic you discussed. In regards to networking, there will be a similar approach. Must be ordinary and necessary, but it is not limited as the meals.

Uniforms and Personal Grooming.

- In the F&B industry, you will most likely be providing uniforms to your employees. These are deductible. They must have the logo of the company, or it needs to be a special type of outerwear, shoes, etc. (for example, steel-toe shoes) that is meant to protect the employee and/or you. It can’t be everyday clothing like jeans and T-shirts.

- You most definitely can’t deduct hair appointments unless you are a model, actor/actress, etc. The rest of us must pay for it. It’s the price we pay to be good-looking.

Whatever you do, please always find a tax professional that specializes in your type of business/industry. Don’t watch TikTok videos for tax advice. Also be aware that not every tax professional will specialize in all industries/business types. Do your due diligence. Click Here for some tips to help you choose the right tax professional for you.

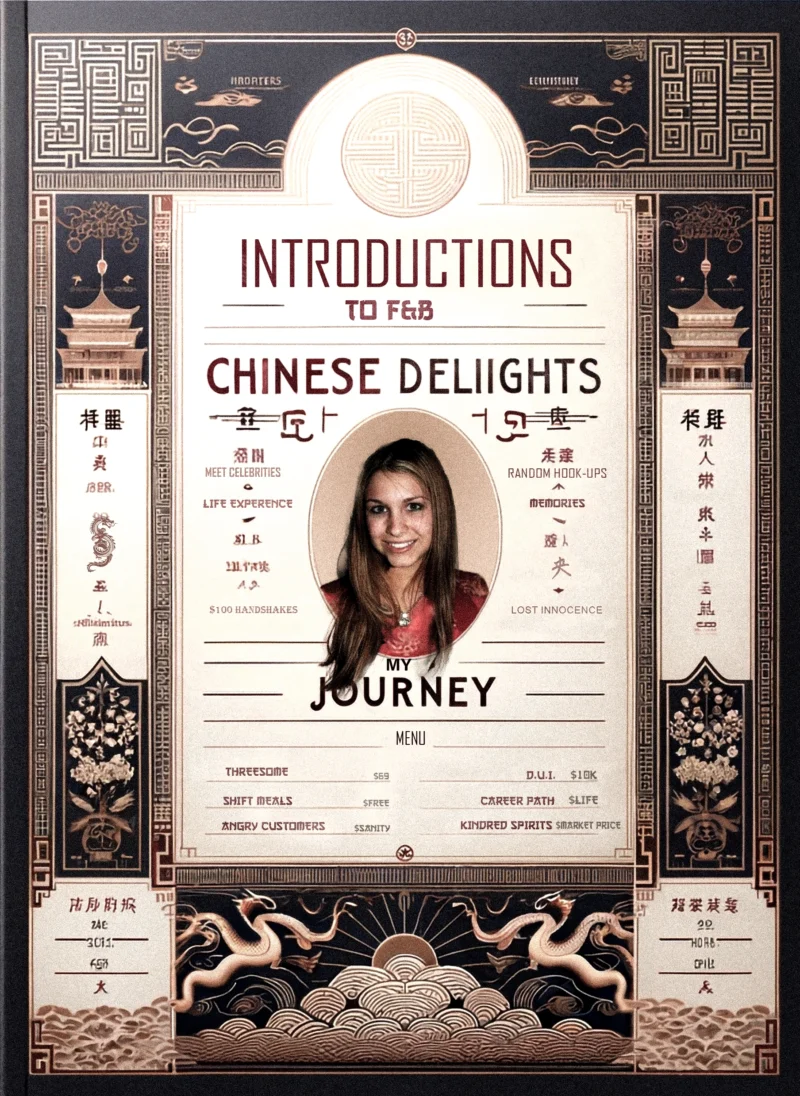

Tax Tips at Deduction Junction in 86'd Me: Serving Financial Savvy to F&B Workers | Image by Karolina Grabowska

Deduction Junction,

I have a friend that hasn’t filed in a long time….. what would be your advice to her?

She’s a bartender and I believe it’s been over 8 years since she filed. Help!

—Jay

This one is easy… SHE NEEDS TO FILE! The bad news is, if she had refunds, she lost most of them, because you can only go as far as 3 years back to claim refunds.

The even worse news is if she owes money. The interest, penalties, and fees keep increasing fast and the IRS can put a lien on her bank account or even go after her house, etc. Don’t think that because she hasn’t filed, the IRS doesn’t know of her income. If she got W-2s, 1099s, etc., then the IRS knows about it. If by any chance she got paid “under the table”, they have ways to get to her as well.

My recommendation is to file immediately. If she owes, she can get a payment plan. If she gets a refund, then she will be able to at least get the last couple years back. Either way, never ignore the IRS.

You know what they say, there are 2 sure things in life: death and taxes

Trending

The Top 5 Cities For F&B’rs

Cities where we can flourish

Weighing Culinary Diplomas Against Kitchen Battle Scars

Top 5 Cities Where F&B Pros Shouldn’t Detour

Hooking Up With Coworkers

Is It Ever a Good Idea?

The Hostess with the Mostless

If you’ve ever worked in a restaurant, you’ll recognize the…

$1.6 Million in Unpaid Tips head back to Servers Pockets

Explore the ongoing battle for restaurant workers' rights in South…

Drink Me

Dive into the "Traveling Bartenders" Facebook group, where bartenders find…

Behind Bars

Dive into the dimly lit world of NYC's most notorious…

86’d Healthcare

Jerry shares a compelling insights into the critical healthcare challenges…

Braveheart

Join us on a journey through the chaotic world of…