The Hollandaise Method: A Financial Guide for F&B Workers

Part 1: The Foundation - Building a Sturdy Financial Safety Net

| Estimated Reading Time: 5-6 Minutes

I

n a former life I used to work with Ryan. I was FOH and he was BOH.

Back then neither of us were thinking about money planning, just where we were getting our after work drinks.

Ryan went to Johnson & Wales and earned a BA in Nutritional Science.

These days he works in financial planning. I asked him to give those of us still in F&B a little advice on how to make some plans so we are not broke and broken later.

Introspection

The quick flash of wondering where you were, where you are now, and what’s next.

It’s like opening a hot convection oven, a quick jolt of hot air to face.

You may have had one during pre-shift bustling to prep your station, or maybe you’ve had it smoking the last cigarette after closing the bar down.

Sometimes there’s satisfaction in the moment, other times… not so much.

Then there’s the glimpse of the future notions of working so long that you don’t think you can ever stop.

My introspection came from the late-night cigarettes thinking about my end game.

I could stay in the grind until my back shaped into a question mark to remind me why I did it so long, I could work an institutional job to sacrifice cooking for better hours, or I could go sell cases of frozen chicken fingers.

It’s not that these paths were bad, it just wasn’t the end game I wanted. I didn’t know what I wanted, but I knew what I didn’t want. I didn’t want to work forever.

I didn’t want to be so broke living paycheck to paycheck.

I wanted to know how I could start saving for a house on a Cook’s/Server’s pay.

I didn’t want to keep seeing friends from yesteryear buying a house, while I’m bumming around the kitchen asking about a roommate for the next lease.

I felt hopeless. And I felt hopeless because I had introspection without a plan.

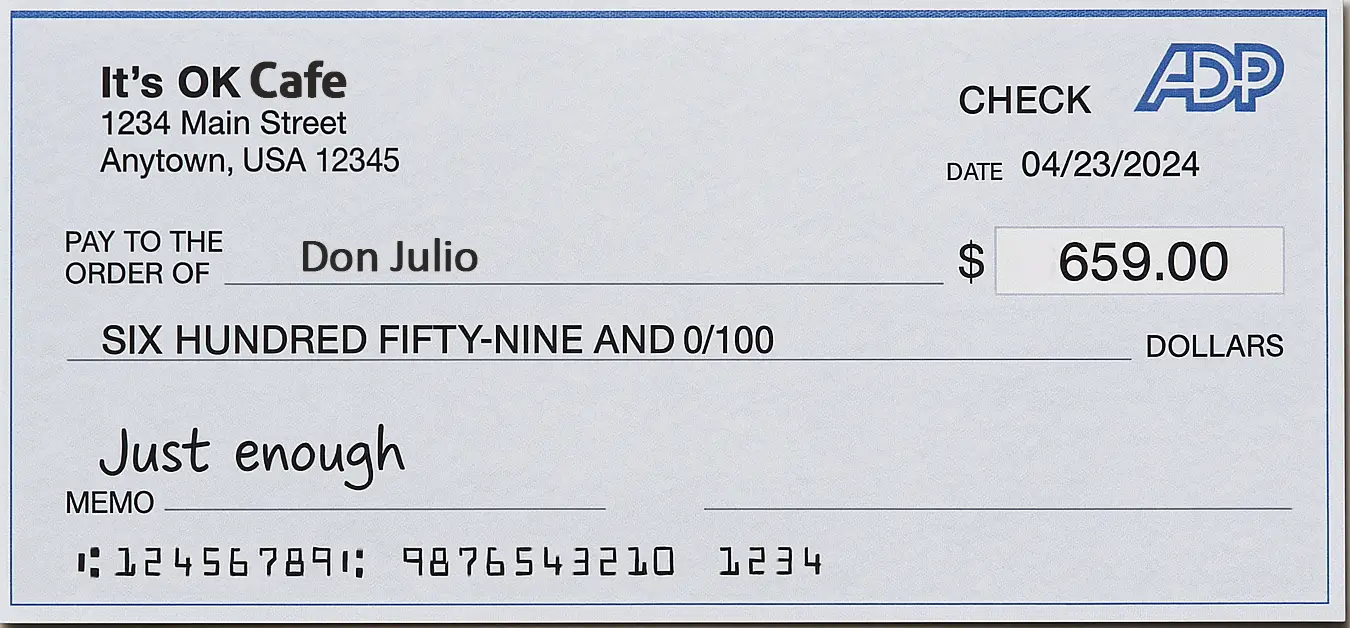

| Image by Check

It is possible to stop working and still be okay. I help people with it all the time.

With the right knowledge and plan, the idea of not working until death becomes very real.

And if your problem is living paycheck to paycheck, you’re not alone.

In 2024, 36% of Americans making over $200,000 a year were in the same boat.

What’s missing? Consistency and planning.

Does this mean you have to eat ramen for the rest of your life?

No , but it may mean making some adjustments. So where do you start? Or maybe you’ve already started, but don’t know what comes next?

Planning for the future you want is kind of like making hollandaise sauce (and I’m not talking about using the Robot Coupe because only an asshole does it that way).

Mixing bowl and whisk. It’s a bitch to make , not because it’s hard, but because it requires action and attention.

If it breaks, game over, start over (and if you use xanthan gum to stabilize, you’re worse than Robot Coupe guy).

But when that hollandaise comes out right, it’s thicc gold.

It was made with the right ratios, the right temp, and the right method. So how do you create your thicc gold future?

What is the right ratio, the right temp, and the right method for you? It depends.

|

The first step is creating the right environment.

Like anything that lasts, it starts with having a strong foundation.

This is where you build a sturdy safety net to give yourself the best chance for the future.

It is crucial because this is what covers you for the unexpected stuff.

Car breaks down, home needs a repair, copay on a medical bill the “oh shit” stuff.

No matter what it is, the two worst things you can do are either tap into a retirement account or add to debt via credit or a repayment plan.

This step is your buffer to protect yourself. Protections include having a Money Map, Emergency Savings, and insurance with Living Benefits.

Money Mapping is just a fancy way of saying budget , but don’t roll your eyes yet.

Think of it like breaking down prep: you can’t run a smooth service if you don’t know what’s on your station.

Same thing with money. When you track what’s coming in and where it’s going, you see right away if your future looks solid or if it’s a mess.

Paycheck money is rent, bills, groceries the stuff that keeps you alive.

Playcheck money is the fun side drinks after work, hobbies, little splurges that keep you from losing it.

Once you know which is which, then you can actually start stacking savings.

Emergency savings are a must. If nothing else, they should always be the priority.

Aim for 3–6 months of net income.

Two things happen when funding emergency savings: your essential expenses are covered for months, and you build a positive money habit.

Once your goal is achieved, stop funding it. Emergency savings should be for emergencies only.

If you’re saving for something like a vacation to Thailand, that belongs in a separate playcheck account.

The good part of emergency savings is it will be there when you need it; the bad part is it’s not growing for the future.

Cash in your mattress only loses value, and a savings account with .80% return doesn’t help much either.

| Image by Mattress Savings Account

The next component of the first step is life insurance.

And no, this isn’t just about “if you die, your family gets money.”

The kind I’m talking about has Living Benefits, and it’s only available through individual policies offered by a select few companies.

Living Benefits let you use life insurance money if a major medical event happens.

This is how you avoid being part of the 49% of Americans carrying medical debt.

Heart attack, stroke, cancer , even with health insurance, deductibles and copays pile up.

A Living Benefits policy can pay out a portion of the death benefit to offset those bills.

The primary purpose of this insurance is in case you don’t die.

Once you have the first step planned, you have a much better chance of reaching your goals.

If you need a resource to get started or to check in, I can be that person. I’ve made plenty of hollandaise, and just like it takes the right tools and attention,

I have the resources to help you whip together your future.

“Future you” will be grateful that “present you” made the step.

Except for Robot Coupe guy.

There’s no coming back from that.

This is just the first step.

Join us for Part 2 as we continue to build the “Thicc gold” of your financial future.

Want to learn more or connect with Ryan?