No Tax on Tips: The 2026 Guide to Your $25,000 Tax Deduction

Everything you need to know about the "One Big Beautiful Bill" changes for your 2025 tax return and how to claim your mid-year refund.

| Estimated Reading Time: 8 Minutes

Filing your 2025 taxes in 2026 requires a new roadmap. With the historic “No Tax on Tips” provision officially live, hospitality professionals can now access a federal income tax deduction of up to $25,000. This guide provides the step-by-step navigation you need to identify your job code, understand your eligibility, and ensure your 2025 refund is processed correctly during the 2026 filing season.

f you’re in F&B and waiting for the IRS to send you a “Thank You” card for reporting your tips all these years, I’ve got some good news and some bad news.

The bad news is that the card isn’t coming. The good news?

The No Tax on Tips law is officially live for the 2025 tax season, and for the first time ever, the government is comping the bill on your federal income tax for every dollar you’ve earned in tips up to $25,000.

So 2025 was a whirlwind. Here’s a quick review that’s actually relevant to F&B’rs.

The One Big Beautiful Bill was passed, and it included the “No Tax on Tips” provision, which gives tipped workers a deduction of up to $25,000 on their taxes.

The bill was signed into law on July 4th and runs through 2028.

The Library of Congress |

I’ve already written a couple of articles on different parts of this, so if you need to get up to speed, you can check those out first. I’ll add links for you..

Since the bill was signed into law mid-year, there has been some confusion about how this is all supposed to work. That’s why I’m here.

In this article, I’ll try to answer as many real questions as I can.

I want to help make this year’s tax filing easier, and hopefully help us keep a little more of the money we actually earned.

We’ll get into who actually qualifies, what counts as tips, what paperwork you’ll need, and much more. Ill even do a mock turbo tax filling to help out as well.

Who Qualifies for No Tax on Tips?

First things first lets talk about who qualifies for the TIP deduction.

Originally there were some gaps and grey areas with this, but now the IRS has defined it a little better.

According to IRS Notice 2025-69, qualifying for the $25,000 deduction isn’t just about your job title it’s about the money itself, which is different from where we started.

In plain English: To qualify, you must be in an occupation that “customarily and regularly” received tips before 2025, and those tips must be “Qualified.”

To determine if the tips are qualified, the IRS made a 4 tier test based on Revenue Ruling 2012-18:

Tier 1: Voluntary

The payment must be made free from any compulsion. If the guest has to pay it to leave the building, it’s a service charge, not a tip.

Service charges do not count as Tips, I repeat, do not count as tips.

Tier 2: Unrestricted Right

The customer must have the unrestricted right to determine the amount.

Suggested” tip percentages on a receipt are okay, but if the computer locks in a certain amount that the guest can’t change, it fails this tier.

Tier 3: Not Negotiated

The payment cannot be the subject of a negotiation or dictated by employer policy.

This is why “contracted” events or banquets are tricky. If an establishment and guest sign a contract saying “24% Service Charge ,” included in the bill. That is a not a negotiation, meaning that money is taxable wages, not a “Qualified Tip.”

Tier 4: Customer Determines

Generally, the customer has the right to determine who receives the payment. In most cases, except for Tip pools.

The Tip Pool Rule: Tip pools are counted as “Qualified Tips” when shared among the staff, not with the owners. Even if the guest doesn’t hand it to the person directly, it counts.

Example: Through a tip pool, a dishwasher gets a cut of the tips. Since it was intended to be shared with staff, that money is counted as a Qualified Tip.

What is NOT a Tip: Service charges or gratuities are NOT considered tips unless the guest has a choice to not pay it or change the amount. This is where it gets blurred a little, and you might have to use your own discretion at least for this year.

gratuity | Image by gratuity

Example (Banquets):

You work a banquet and there is a 24% “Service Charge” on the bill or contract. That 24% is a wage, not a tip. But if the guest decides to leave an extra $100 on top, only that extra $100 is a Qualified Tip.

The “Suggested” Rule:

A gratuity added on a check is NOT a Qualified Tip unless the guest has the option to leave zero or change the amount (like a “Suggested Gratuity” button on a screen).

Alright, breathe.

Determining what jobs qualify as tipped positions is the second part of the equation.

Now the IRS has added some more positions to this list which is great for BOH staff and some others.

This is a pleasant addition to the rules.

The IRS has a list called the Treasury Tipped Occupation Code (TTOC). This is the official IRS list of 68 job categories that the Treasury and IRS recognize as traditionally tipped occupations for purposes of the No Tax on Tips deduction.

The list includes some jobs, such as dishwashers and cooks, that were not traditionally considered tipped workers under the Fair Labor Standards Act but can be included if they participate in a valid tip-sharing agreement.

| Image by Tired F&B'rs

Income Thresholds & Restrictions

Some other restrictions for the deduction are the MAGI ( Modified Adjusted Gross Income).

Here are The Thresholds: to receive the max 25k tax credit,

but you still get some $$ if you’re over the threshold. Here’s how it works.

-

Single / Head of Household: You’re good up to $150,000

-

Married Filing Jointly: And if you’re married its $300,000.

And if you make more than the 150k MAGI, the IRS doesn’t just cut you off.

It’s a sliding scale. For every $1,000 you earn over that limit, your $25,000 deduction is reduced by $100.

Also, if you’re filing married and both work in the industry, you get screwed. You only get one deduction when you file.

Sorry And by law your are required to file Jointly to get any Deduction.

If you file Married Filing Separately, you are disqualified from the deduction. (Section 224(b))

The 2025 “Transition Year” & Your Refund

Since the One Big Beautiful Bill (OBBB) was signed into law on July 4, 2025 right in the middle of the tax year the government didn’t have time to update employer payroll systems or withholding tables before the year ended.

Because of this, the IRS has officially designated 2025 as a ‘transition year’ under Notice 2025-69.

Most restaurant owners spent the second half of 2025 taking federal income taxes out of your tips as if the old laws were still in place.

This means you likely overpaid the IRS on every shift since July.

As a result, many food and beverage workers will see a larger-than-normal refund this spring when they file their 2025 returns and claim their new tip deduction.

Forms And Paperwork

When you get your W-2, it’s going to look just like it has in the past. For 2025, employers were not required to change how tips were reported on your W-2.

Because your W-2 doesn’t change, the IRS isn’t automatically giving you the deduction. You’re claiming it as part of your return, using additional forms that feed into your final tax calculation.

You should also be aware that you still pay taxes on SS and on Medicare, so there is no change to this.

Filing Your Return

If you’re one of the lucky ones and your W-2 already separates your hourly wages and your tips, that’s the easiest situation to be in.

It makes identifying your tip income straightforward.

But if it doesn’t, don’t stress. That’s very common for 2025.

The IRS allows reasonable methods for determining tip income, especially this year.

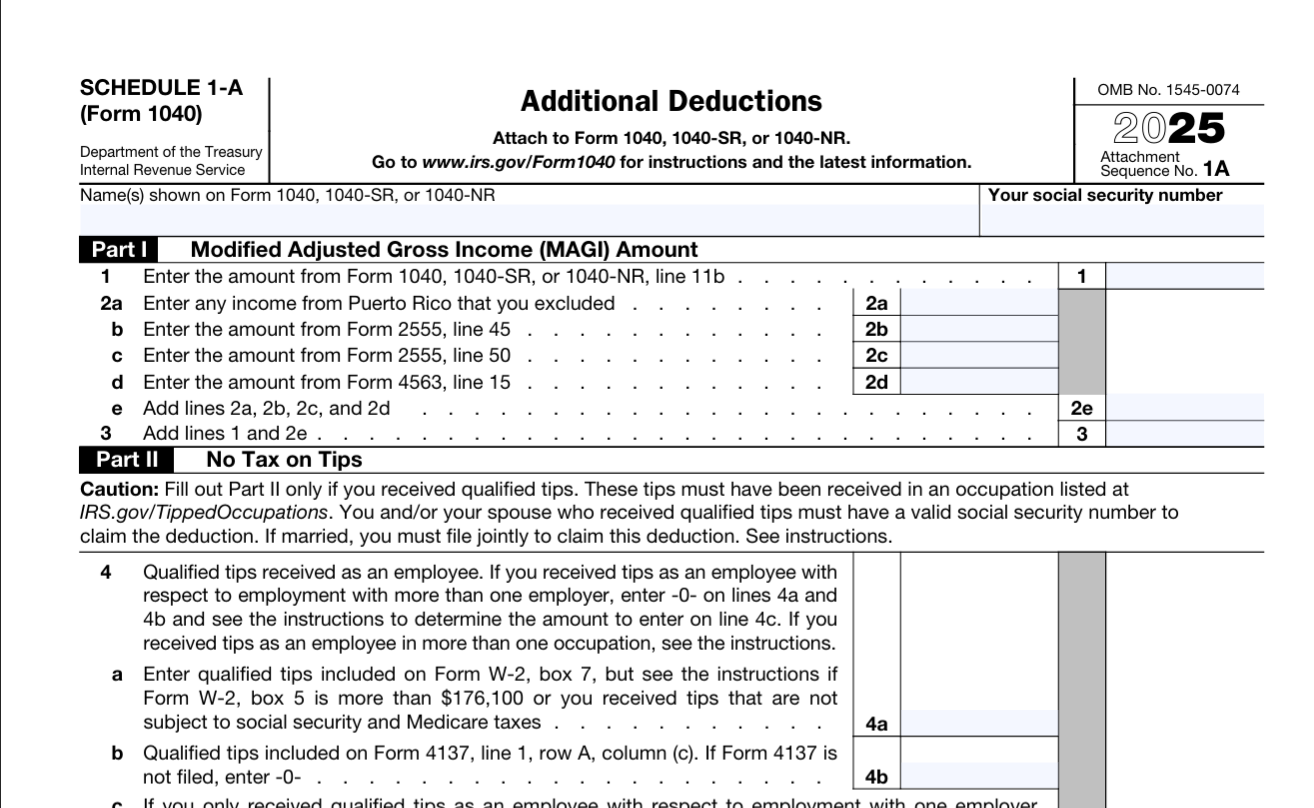

Schedule 1 A Form | Image by Schedule 1 A Form

The Main Form: Schedule 1-A

Schedule 1-A is the form that makes the No Tax on Tips deduction happen. If this form is not included in your return, you do not receive the deduction. This form is part of your tax return and feeds directly into your final tax calculation.

A few key things to know:

-

Your employer does not fill this out.

-

This is in addition to your W2.

-

This is completed when you file, not during the year.

If you’re using tax software, you won’t be manually filling out Schedule 1-A.

The software will ask you questions about your tip income and apply the deduction automatically based on your answers.

No Schedule 1-A, No Money!

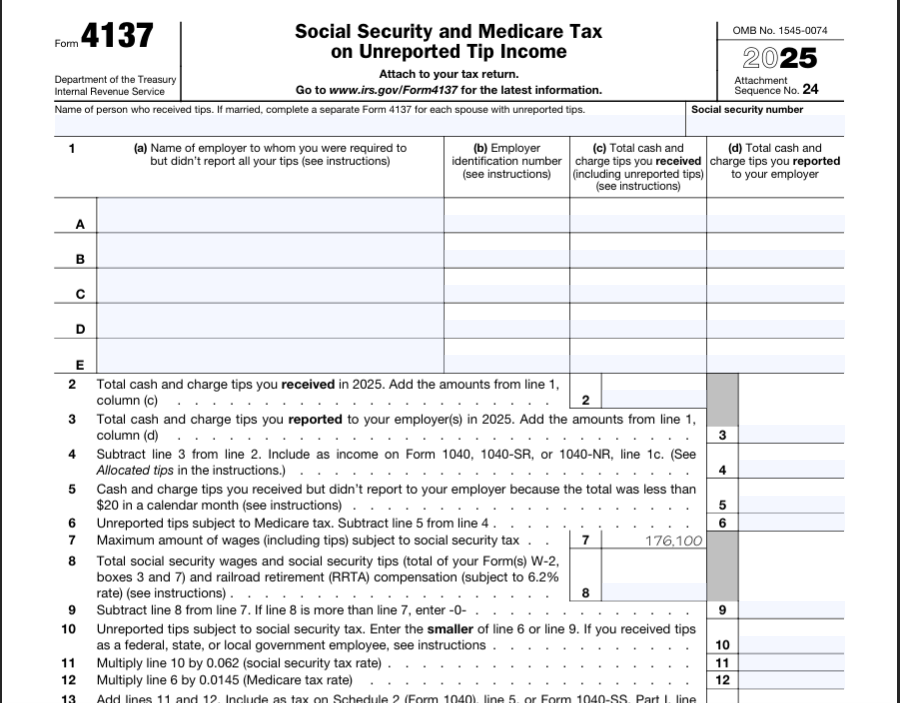

Form 4137 | Image by Form 4137

Form 4137

If all of your tips were paid by credit card and already showed up on your paystubs or W-2, you can probably skip the next part.

But if you received cash tips that never made it into payroll, there’s one more form that comes into play: IRS Form 4137.

Any cash that is not on CC tips is declared here. Form 4137 is just one part of the process. It makes sure any missing cash tips are included so Schedule 1-A can apply the No Tax on Tips deduction correctly.

TurboTax Walkthrough

Before guessing or assuming anything, I wanted to see how this actually plays in 2025 Tax software.

SoI ran a mock return through TurboTax to check if the new No Tax on Tips rules were built in.

What I found out was if you just follow the prompts, it’s not as straightforward as it should be.

One thing that isn’t explained very well is how tax software handles the No Tax on Tips deduction.

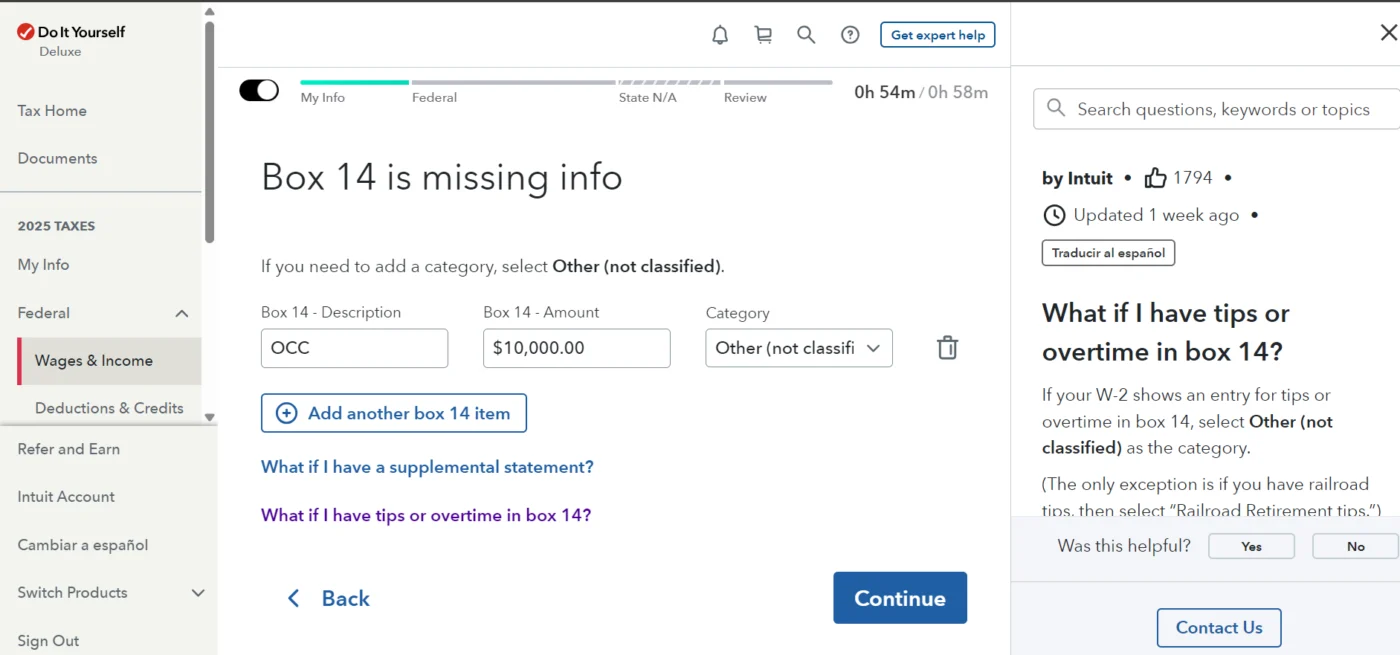

You don’t actually fill out Schedule 1-A or Form 4137 manually. Instead, the deduction is triggered by how you answer certain questions earlier in the process.

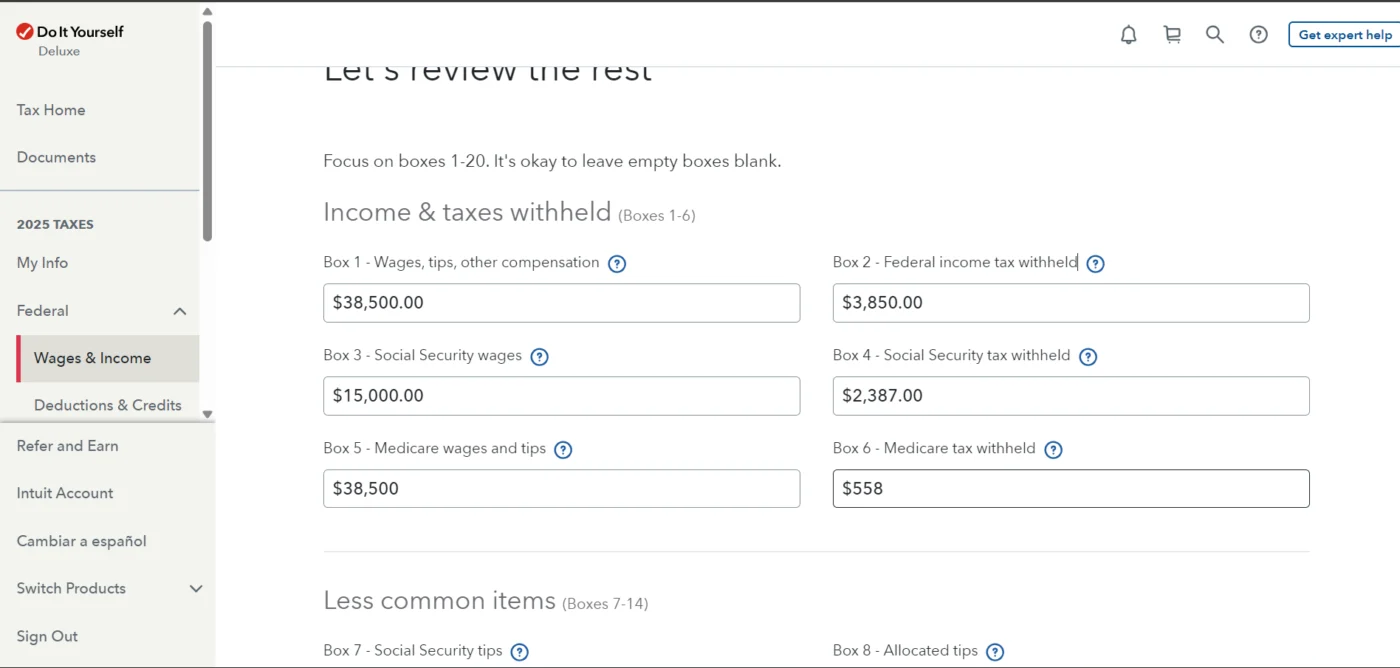

Turbo Tax Box 1 |

The first place this causes confusion is when you’re entering your W-2. Everything looks exactly the way it always has. Your total pay goes in Box 1, and in most cases that already includes your tips.

The next spot that trips people up is Box 14, which some employers label as “reported tips.” This box is informational only.

Turbo Tax Box 14 |

When you answer yes to having unreported tips, the software creates Form 4137 in the background. After answering a few more follow-up questions,

TurboTax brings you to a summary screen showing your total reported tips and unreported cash tips together.

At that point, the software determines whether you qualify for the No Tax on Tips deduction.

I’m not a tax professional, just an F&B’r trying to help out.

Learning what really matters is a slow and painful lesson.

For next year, do yourself a favor and keep track of your tips as you go. It’ll make filing a lot easier.

2025 was messy because this rolled out mid-year. Next year should be easier once payroll systems and tax software catch up, or at least that’s the hope.

Whether you love the One Big Beautiful Bill or hate it, nobody in this industry is turning down keeping more of their own money.