Saturday, October 7, 2023

Dear Erica,

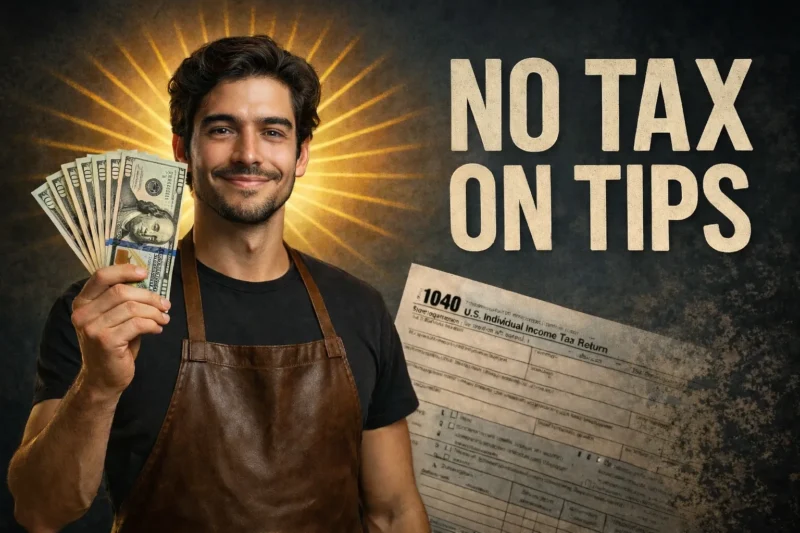

- How do they calculate taxable income for tipped employees?

- Do they take into account cash sales and, therefore, the assumed cash tips on those sales?

– Zoe

- Taxable income for tipped employees is calculated by adding their reported tips to their regular wages. Your employer reports it in a W-2 provided to you at the end of the year. From there, the taxable income will be determined by your deductions and adjustments when you file your tax return and will be taxed at your regular tax rate.

- No, the IRS doesn’t make any assumption on the form the tips are paid. As a tipped employee, you are responsible for keeping daily records of tips received and providing them to your employer so taxes may be withheld.